Best of Market Sentiment (First Half of 2025)

Alpha 20, Gold, Stagflation, and more...

Thanks for subscribing to Market Sentiment. With your support, 2025 has been an incredible year for us. We crossed 50K readers last month, launched Rebound Capital & Market Sentiment Pro, and will launch 930Alpha next week1 (yes, we haven’t forgotten about it :))

You do excellent work delving into different investment strategies and ideologies. It has lead me down different paths of learning about investing from what I already knew. Thank you for the work! — Russell Miller

Anyway, today is a quick round-up of our most popular articles from the first half of 2025. Hope you enjoy :)

The Alpha 20

While everyone knows about Buffett and Berkshire, virtually no one knows about Larry Puliga. Puliga managed to beat the S&P 500 over 28 years, and his stock-picking was so good that he outperformed Buffett in the last 20 years leading up to his retirement.

Inspired by this, we set out to build a list of funds and managers that have consistently outperformed the market for decades. It took hundreds of hours of research, combing through 6,000+ mutual funds across the past three decades, but the results were worth it.

After one quarter, 70% of the 20 funds we selected have outperformed the market, with an average alpha of 2.25%.

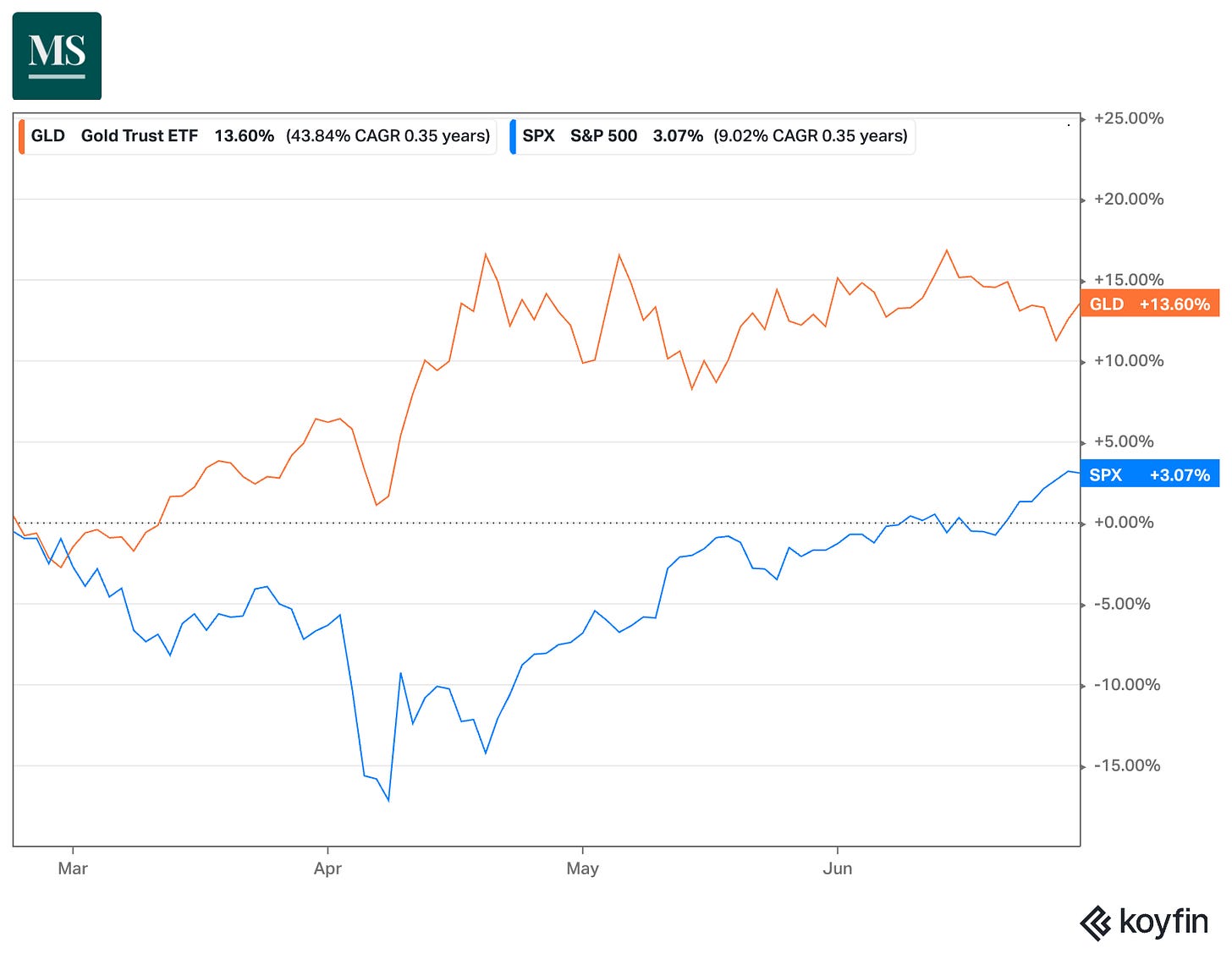

Gold isn’t going anywhere.

We wrote about how gold remains an important asset class a few months ago. The underlying logic was simple — nobody in power seems to be interested in managing the ever-increasing U.S. debt.

Since the publication of our report, Gold has outperformed the S&P 500 by 4.4x! Everyone from retail investors to central banks is buying gold at an unprecedented rate.

Gold is the ultimate anti-debasement asset. An ounce of gold would have bought 690 hot dogs in 1906, and after more than 100 years, it would still have gotten you 675 hot dogs in 2024.

It also has all the makings for an excellent portfolio tool:

Gold has outperformed U.S. bonds, commodities, and global equities over the past 20 years.

Gold has zero correlation with both equities and bonds.

It’s an excellent crisis tool and has outperformed the equity market during periods of elevated volatility.

It’s highly liquid and lags only the S&P 500 in daily trading volume.

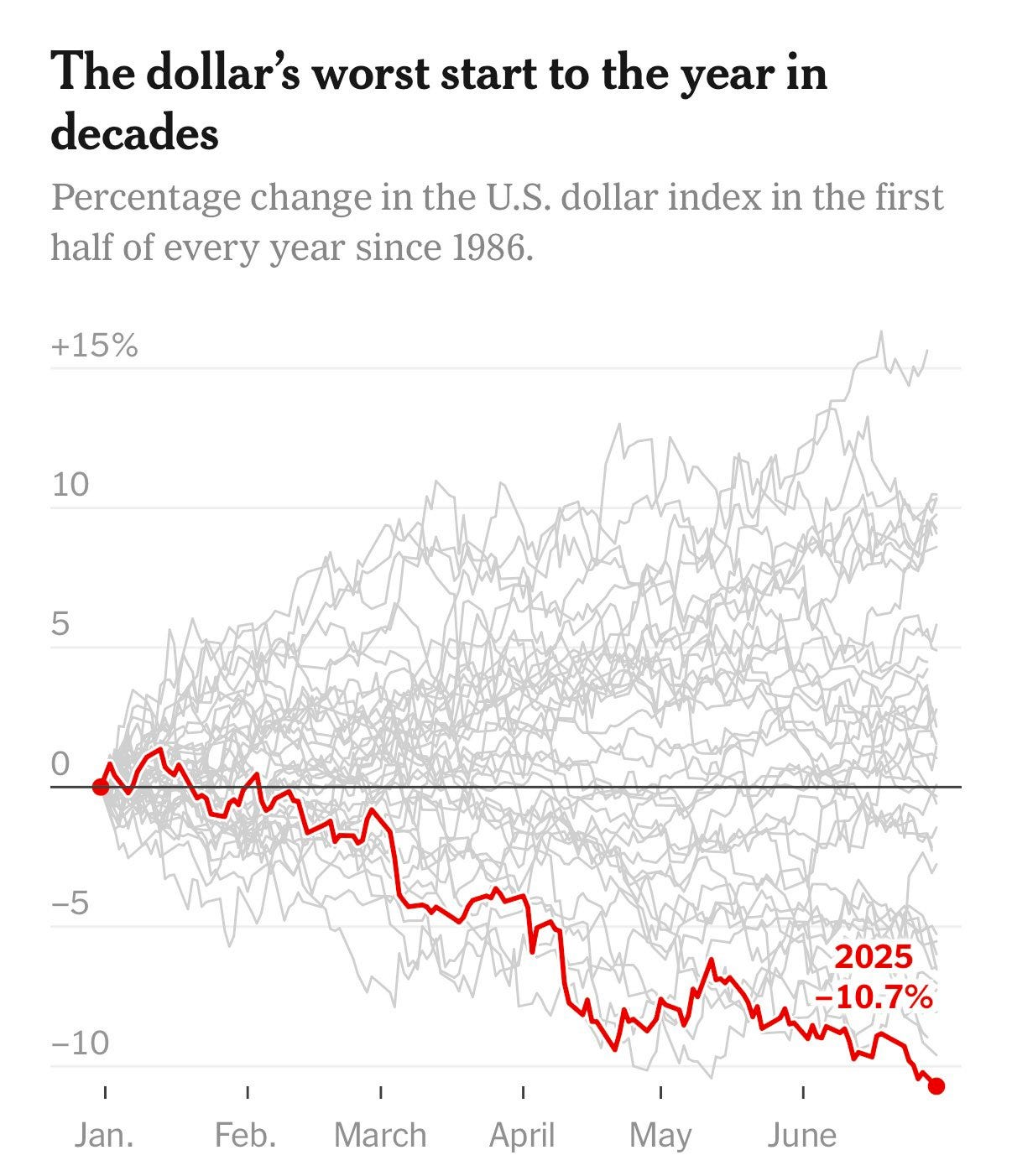

Betting against the $

That brings us to the $. At the end of June, the U.S. dollar index had fallen by 10.8%, its largest decline in 50 years.

During the liberation day stock market rout, for the first time in recent history, the value of the dollar dropped simultaneously with the market.

Uncontrolled spending always leads to inflation, loss of confidence, and the currency losing its purchasing power. With the Big Beautiful Bill passing the Senate yesterday, it’s expected to add another $3 trillion to the national debt over the next decade.

With no one willing to make the tough choice of being fiscally conservative, its time to bet against the inevitable drop in $.

Buy the dip

"Buy when there's blood in the streets, even if the blood is your own."

While it may feel like a few years ago, just four months back, the stock market was in extreme fear, per the CNN Fear and Greed Index. The S&P 500 index was down 10% from its ATH, Trump had started another trade war, and it was the worst start to a presidency in 50 years.

If you have a long investment horizon, the best thing to do is buy the dip.

The market is now up 12% since we published the report.

Stagflation

Last week, J.P. Morgan released a report stating that the U.S. will experience a tariff-induced stagflation in the second half of 2025. They concluded, noting that slowing economic growth and rising inflation could combine to force the Fed to cut interest rates.

We at Market Sentiment called this 3 months back.

“If Trump follows through on these tariff threats, the impact may extend far beyond the next quarter or election cycle.

As history shows, even temporary shocks can leave lasting marks on the economy. Much like the oil embargo of the ’70s, the immediate damage will be visible in months, but the aftershocks could last decades.”

As you can see (and our paid subscribers will vouch for this), implementing any of these strategies on even a $10K portfolio should easily cover the cost of your subscription — many times over.

If you made it till the end and are still on the fence, here is a limited-time 20% discount on the paid subscription. This offer is only valid for 24 hours, and the price is locked in as long as you remain a subscriber.

Footnotes

Over the past 2 months, I believe we have solved some incredible tech challenges. We wanted to wait till the end product felt like magic. All those who signed up, please keep a look out for the first email by the end of this week

Yes of course