Welcome to the latest Ideastorm. Market Sentiment curates the best ideas and distills them into actionable insights. Join 37,000+ others who receive curated financial research.

Actionable Insights

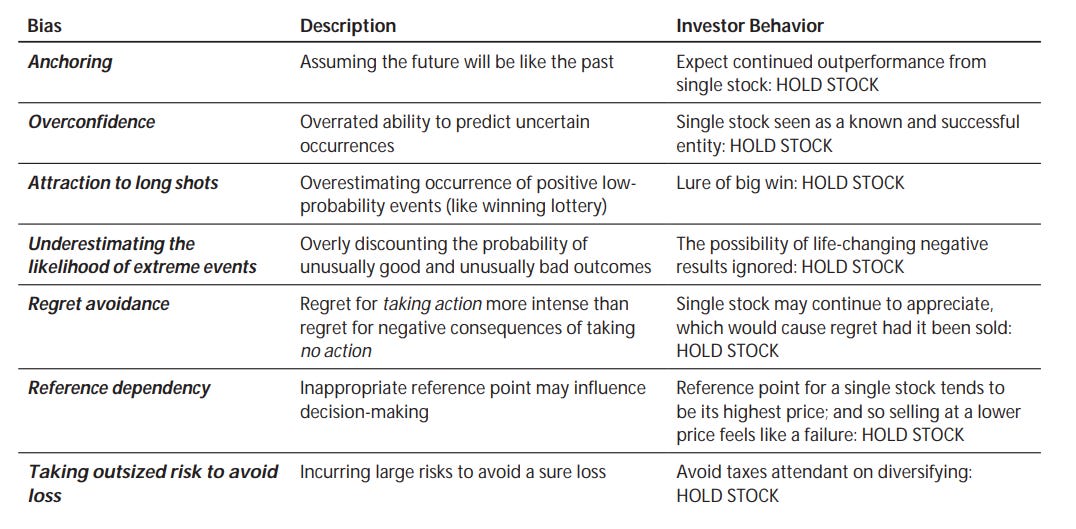

Certain behavioral biases such as anchoring, overconfidence, and regret avoidance push investors towards holding instead of selling an outsized position.

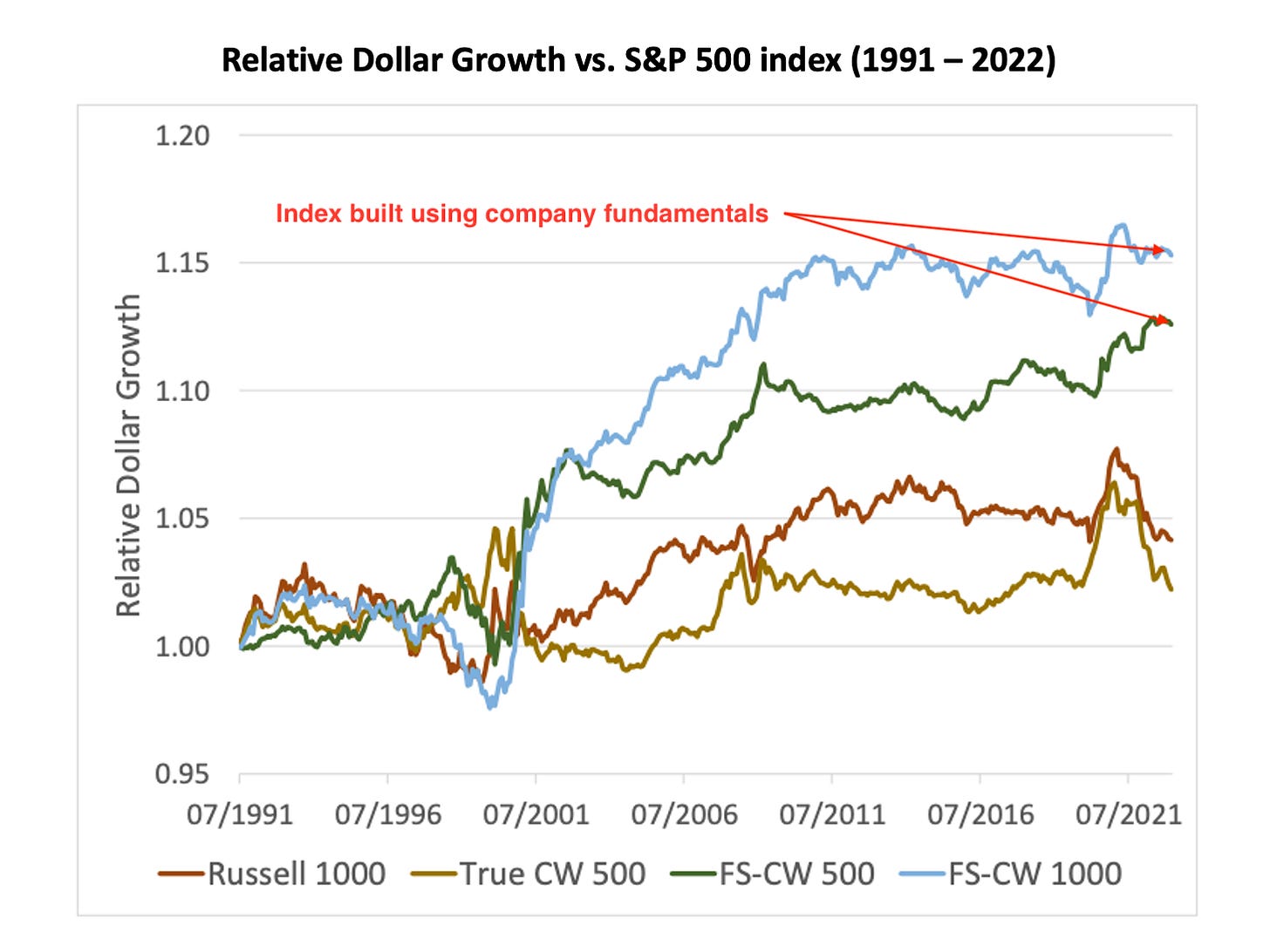

By using fundamental measures instead of market cap weighting, it’s possible to create an index that has a higher return and lower volatility than traditional market-cap weighted indices.

By diversifying effectively, it’s possible to generate positive returns from two uncorrelated assets having zero expected long-term return.

Companies with the highest employee satisfaction earn an abnormal return of 2.7% per year compared to their benchmark.

1. Psychological barriers to booking profit

Glauber Contessoto was the poster child for Dogecoin. In Feb 2021, he put all his life savings ($188K) into Dogecoin. By April, it had grown to $1 million and in the next 4 weeks, his portfolio grew close to $3 million. A 15x return in 3 months!

As with all bubbles, the crash was inevitable. Just a year later, his portfolio dropped from $3 million to $230K (a 92% drop). From our estimates, if he is still holding, it would be only worth ~$200K. The irony is that if he had sold at the top and put it in treasury bills, he would be earning a cool $150K every year. Contessoto understands this and regrets holding on to his investments:

What I do regret is not taking out some of the profit as cash. If I could go back in time, I probably would have taken out $1 million or $500,000. — source

While it looks easy in hindsight, there are a lot of psychological barriers that prevent investors (or speculators) from booking profit.

These behavioral biases tend to push investors in the direction of holding rather than selling. The media also does not help as it is full of stories of investors and employees who held on to stocks like Amazon, Google, and Tesla. But the performance of most stocks is a far cry from these exceptional successes.

Source: The Enviable Dilemma: Hold, Sell, or Hedge Highly Concentrated Stock?

2. A better way to index?

If you think about it, there are no good reasons why the market-cap weighted index became the gold standard for passive strategies. A key issue with the traditional index is that it follows the buy high, sell low approach — Index additions are usually growth stocks trading at a premium and deletions are usually value stocks that have gone out of favor.

If the market benchmark (S&P 500) is based on “buy the biggest companies that are profitable”, shouldn’t we be able to do better by just going one or two steps deeper?

Research Affiliates recently put out a paper that proposed a novel way to create an index. Instead of using market capitalization, they used the average of four fundamental measures to pick stocks for the index.

Current book value adjusted for intangibles

Sales adjusted for the company’s equity-to-asset ratio

Cash flow plus R&D investments

Dividends plus share repurchases

Over 30 years from 1991 to 2022, the indices built using fundamental measures outperformed traditional market-cap weighted indices. The higher returns were generated with a lower turnover in the portfolio (leading to lower transaction costs) and at a lower risk.

Source: Reimagining Index Funds

3. Shannon’s Demon

One of the most important investing ideas you've never heard of is 𝗦𝗵𝗮𝗻𝗻𝗼𝗻'𝘀 𝗗𝗲𝗺𝗼𝗻. Using it, we can consistently generate positive returns from two uncorrelated assets having zero expected long-term returns!

Consider a simple coin flip game to simulate an asset with zero long-term returns. If it’s heads, you win 50% of your bet amount; if it’s tails, you lose 33.3%. This game has a long-term expected return of zero (below is an even coin switch simulation).

At first glance, there is no way to win long-term from this game if we are using a fair coin. We will just broadly oscillate around the original portfolio. But, we can completely change the outcome by making a simple change.

Instead of betting all of your portfolio on every bet, rebalance 50% into cash after each flip -- regardless of whether you win or lose. Intuitively, this should not make any difference, as cash has zero expected return. But, in reality, the CAGR is now positive.

While this might look like a purely theoretical thought experiment, it has real-world implications. Gold and stocks are reasonably negatively correlated. For a 40 year period ending in 2010:

Stocks CAGR: 4.9%

Gold CAGR: 4.0%

50/50 Gold & Stocks rebalanced portfolio CAGR: 5.8%

To understand Shannon's Demon, we must recognize the difference between arithmetic and geometric returns.

CAGR ≈ AVG − (SD²/2)

CAGR: compounded growth rate AVG: average return SD: standard deviation.

When we bet the full amount each time, our average return is higher (~8.4%), but our portfolio volatility is also higher (0.42). Plugging into the above formula gives us a CAGR of zero. 0.084 – (0.421² / 2) ≈ 0%

The volatility has a greater effect than the average return.

By moving 50% of our portfolio to cash, we reduce the average expected return to 4.1%, but the volatility is also cut down to 0.21 instead of 0.42. So, in the new portfolio, the updated CAGR is 0.042 – (0.21² / 2) ≈ 2% This 2% is the edge Shannon's Demon creates.

Source: We have done a detailed breakdown of Shannon’s Demon in this Twitter thread.

4. Do the best companies to work for give the best stock returns?

Fortune annually publishes a list of the top 100 companies to work for globally, a ranking based on an anonymous survey of over half a million employees. This survey measures employee satisfaction and happiness at work and companies try to get on the list by offering perks to attract the best talent.

This raises an interesting question — do companies where people are the happiest generate better returns for their shareholders?

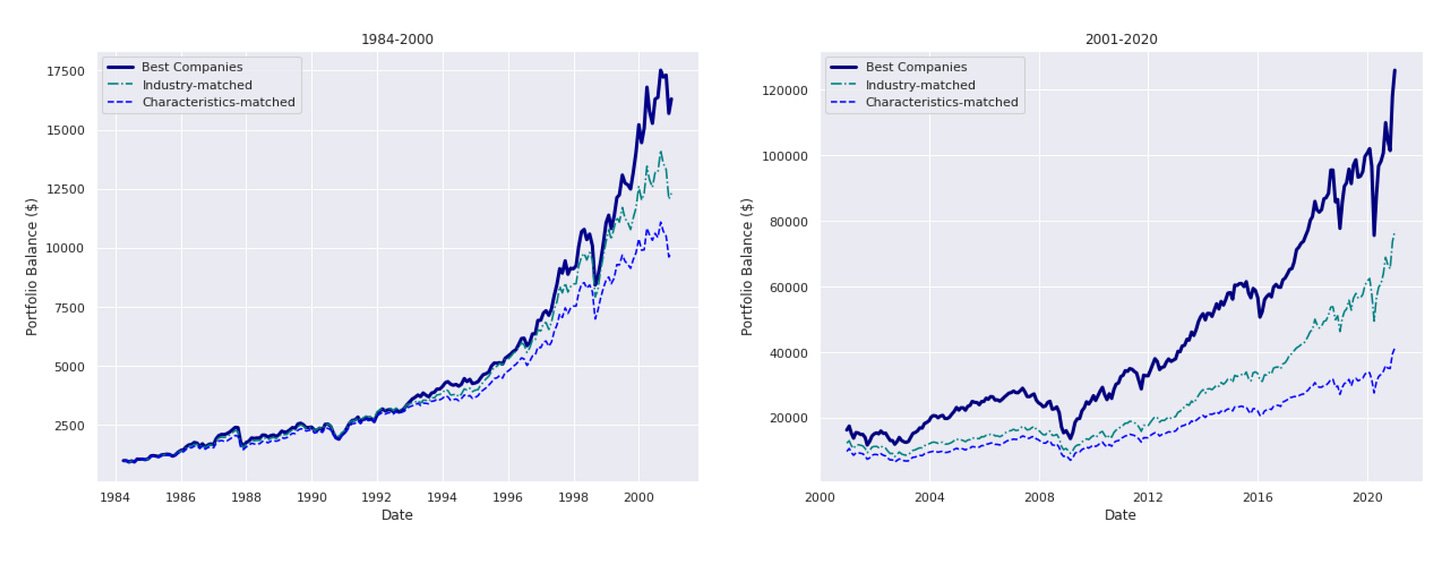

To test this, researchers collected companies that featured in the best companies to work for list going back to 1984 and then created an equal-weight portfolio that gets updated and rebalanced every year.

They found that the equal-weighted portfolio of companies with the highest employee satisfaction earns an abnormal return of about 20 bps per month (~2.7% per year).

In addition to this alpha, companies with high employee satisfaction also managed to handle downturns better.

I think what happens when you have a contented workplace, people are willing to put out more effort to improve operations during really difficult times.

While I think every organization has their ups and downs, the downs are not as pronounced because everybody pulls together to try to get through the crisis. And, of course, this consistently more engaged performance inevitably reveals itself in the firm’s bottom line. — Jerome Dodson (founder of one of the earliest socially responsible funds)

Source: Employee Satisfaction and Long-run Stock Returns

If you found this recently, the poll is closed. Here is the deep-dive:

Market Sentiment is now fully reader-supported. A lot of work goes into these articles, and if you enjoyed this piece, please hit the like button and consider upgrading your subscription to access the deep dives and vote on these polls.

Great post! We spend so much time discussing "what" to buy while the actual profits are made by knowing "when" to sell. It is all about finding the right balance between letting your winners run and taking your profits before they disappear. And this is the most challenging task any investor will face.

Great post. Knowing when to sell is, in my opinion, the most difficult aspect of investing. It’s great to find something that will move up, but assessing when the narrative has changed is immensely difficult. Really enjoyed the chart breaking down the different barriers to selling.