Rule No 1: never lose money. Rule No 2: never forget rule No 1.

Why its important to protect your downside

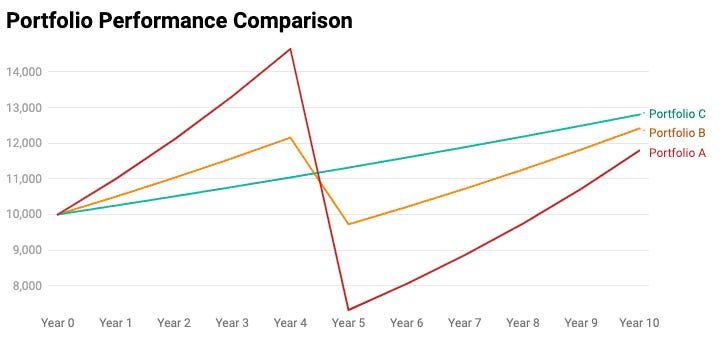

Let’s start with a thought experiment. You are planning to make a long-term investment (10 years) and you have three options.

Portfolio A grows 10% every year consistently but the catch is that once every ten years, it goes through a 50% drawdown. Portfolio B works exactly the same but only returns 5% and has a relatively lower drawdown of 20%. Finally, you have the option of parking your funds in a 10-year term deposit offering 2.5% APY.

The trick here is that most of us tend to allocate more importance to the returns generated by our investments than to their possible downsides. Simple math shows us that a loss of 10 percent necessitates an 11 percent gain to recover. Increase that loss to 25 percent and it takes a 33 percent gain to get back to break even. A 50 percent loss requires a 100 percent gain to get back to where the investment value started. This is why conserving your portfolio is more important than trying for maximum returns.

Coming back to our experiment, portfolio A starts off the strongest generating a yearly 10% return. Portfolio B also outperforms C with a 5% CAGR compared to the pitiful 2.5% return offered by the Term Deposit. But where it gets interesting is once you factor in the drawdown.

After 9 up years and 1 down year, portfolio A would have generated an 18% return (CAGR 1.24%), whereas portfolio B would have generated a 24% return (CAGR 2.18%). But, both of these portfolios would have been beaten by the term deposit offering a CAGR of 2.5% with zero volatility. (In this case, we have assumed the drawdown at year 5. The year in which the drawdown occurs does not matter for the overall return).

If you found this interesting, check out the case for strategic mediocrity.